The US solar energy industry is feeling the effect of the Department of Homeland Security’s June 24th Withhold and Release Order (WRO) on silica-based products made by Hoshine Silicon Industry Company (Hoshine) in the Xinjiang region of China. Despite the WRO causing supply chain disruption, the renewable energy industry remains steadfast to the protection of human rights and enforcement of fair labor practices while pursuing solar energy development goals. Further supply chain disruption has occurred as the result of the US Department of Labor’s June 2021 decision to add polysilicon to the list of goods produced by child labor or forced labor, thus adding to the uncertainty surrounding the solar industry’s supply chain.

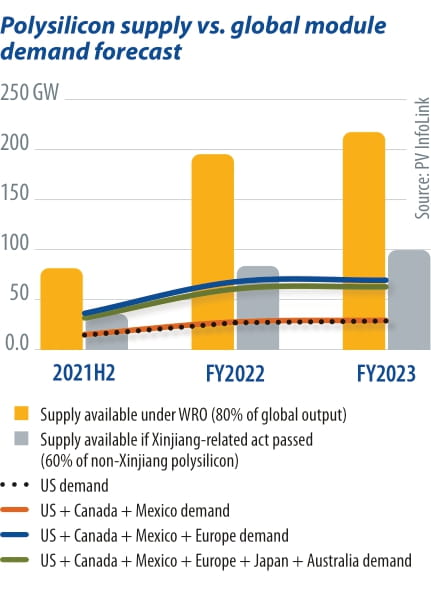

Figure 1: Polysilicon supply vs global module demand forecast.

Customs and Border Patrol (CBP) has recently stepped up its enforcement efforts through the detention of goods produced by unethical and forced labor practices, with nearly 100 MW of Jinko Solar’s PV panels having been detained from inbound shipments, causing them to seek alternative sources. With the current policies in place, the disruption potential for nearly 2.1 GW of US solar projects in the pipeline over the next couple of years cannot be ignored. The WRO does not place a ban on products imported from Xinjiang; however, the threat of seizure and the burden of proof required to release seized items is complex due to the 90-day appeal window required by CBP and the uncertainty within the supply chain. To prove that panels, or their components, did not originate from Hoshine is a high bar to cross for most companies due to the lack of transparency and the general ambiguity in determining the source of supply during the PV panel production and manufacturing process (Lin, 2021).

Adding to the solar module supply chain scrutiny is the potential passing of the Uyghur Forced Labor Prevention Act within the US Congress. The act would ban imports from the Xinjiang region altogether. A June 2021 article from Bernreuter Research points out that the top eight polysilicon manufacturers worldwide are customers of the Xinjiang-based Hoshine Company, and in 2020 those manufacturers contributed to 90% of the global solar-grade polysilicon output (Bernreuter, 2021). Hoshine contributes to nearly 20% of the global silicon production alone, with other companies within Xinjiang adding an additional 20% of the world’s polysilicon output, making the region responsible for 40–50% of global production.

Future demand for polysilicon: what does this mean for the solar industry?

The United States is not alone in its pursuit of standing against forced labor within the industry. Many countries within the EU, in addition to Australia, Japan, Mexico and Canada, have raised concerns regarding the labor practices in Xinjiang. So, what does this all mean for the solar industry and the global price and demand for polysilicon going forward? We have already seen Jinko Solar change their source of supply to a polysilicon producer located outside of Xinjiang, with other companies likely eyeing a similar move considering recent U.S. Customs events. The current price of polysilicon remains high at around $28.50 per kg, with future forecast showing a decline in price over the coming years with the current supply chain in place. Prices of PV panels made outside of Xinjiang currently cost about 10% more than those made within the region, so developers must be ready to pay more for panels if restrictions are put in place (Bernreuter, 2021).

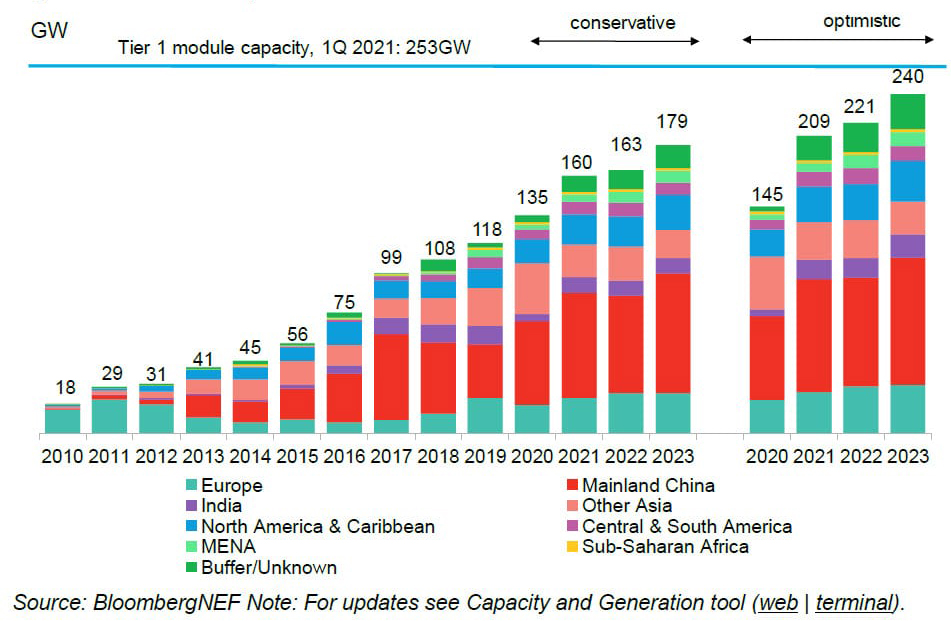

Figure 2: PV new build, historical and forecast.

With the threat of sanctions on the horizon, many wonder if the demand needs for polysilicon can be fulfilled by sources outside of Xinjiang. The anticipated global market demand for new PV projects over the next two years is forecasted to be 221 GW in 2022 and 240 GW in 2023 (Bellini, 2021). If legislation is passed and polysilicon from Xinjiang is banned, it is estimated that the global supply from sources outside of Xinjiang would be able to supply enough polysilicon for approximately 84 GW and 100 GW in 2022 and 2023, respectively, and can therefore keep up with the anticipated demand within the US market during that period (Lin, 2021).

Where there is real uncertainty is the effect that additional bans from other nations (EU, Canada, Japan, etc) on polysilicon from Xinjiang could have on the market. Global solar industry associations, including Solar Energy Industries Association (SEIA) and SolarPower Europe, have issued statements condemning human rights abuses in the Xinjiang region and have called for an increase in transparency. The current polysilicon supply predictions indicate a shortage of polysilicon if there is a global call to sanction production from Xinjiang and rely upon manufacturers outside of the region instead.

From a commercial perspective, what does this mean for projects under development? First, with legislative uncertainty comes market uncertainty. The US Congress vote on the passing of the Uyghur Forced Labor Prevention Act could be the first domino to fall in a set of broad global sanctions against industries within the Xinjiang region. Supply chain certainty is not only vital to individual projects and portfolios but also to fulfilling the renewable energy targets set forth by the Biden Administration.

Determining project risk

Risk is inherent to every solar energy development project. From initial site selection through commercial operation date (COD) and all stages in between, there is a need for all parties to be aware of external influences that can affect the project’s success. Developers, investors, and lenders alike must remain aware of both industry and legislative developments in the coming weeks and months as both the United States and EU explore the situation in Xinjiang more thoroughly.

Natural Power continues to monitor developments on this topic closely on behalf of our sponsor and investor clients.

References

Bellini, E. (2021, February 23). BloombergNEF expects up to 209 GW of new solar for this year. Retrieved from PV Magazine: https://pv-magazine-usa.com/2021/02/23/bloombergnef-expects-up-to-209-gw-of-new-solar-for-this-year/

Bernreuter, J. (2021, June 25). What the U.S. ban on Hoshine Silicon means for the PV industry. Retrieved from Bernreuter Research: https://www.bernreuter.com/newsroom/polysilicon-news/article/what-the-u-s-ban-on-hoshine-silicon-means-for-the-pv-industry/

Lin, C. (2021, September 14). Polysilicon amid international trade disputes. Retrieved from PV magazine: https://www.pv-magazine.com/2021/09/14/polysilicon-amid-international-trade-disputes/