Leading renewable energy consultancy and service provider, Natural Power, has supported the purchase of the Rupella portfolio, one of France’s largest operational onshore wind projects coming to the market in the past 12 months. Commissioned by the consortium of Amundi Energy Transition, TTR Energy, Hexagon Renewable Energy and Green Electricity Master Invest IV, Natural Power completed the buy-side technical due diligence for this acquisition.

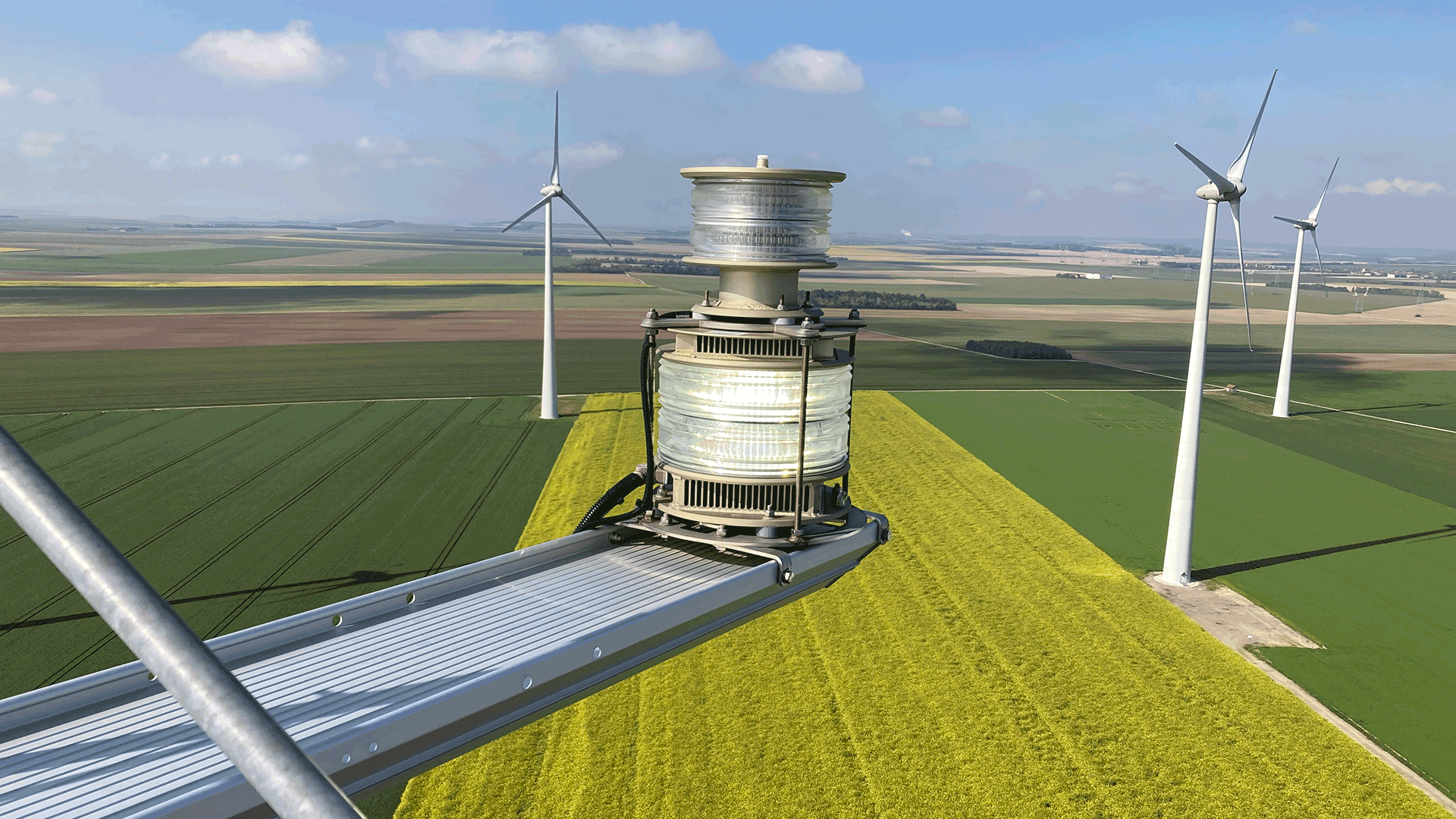

Amundi Energy Transition takes a majority stake in the portfolio, while TTR Energy will manage the portfolio. Comprised of eleven wind farms collectively producing more than 250GWh annually, the Rupella portfolio, which is situated in the north-east of France, attracted significant interest from both strategic and financial investors.

The deal was supported by Natural Power’s European advisory and analytics team with strong project delivery from the team locally in France, providing a comprehensive review of the vendor due diligence report, including reviews of energy yield figures, operational data, technology, O&M contracts, and compliance; as well as site visits and assessing the feasibility and financial technical inputs for a lifetime extension for all the assets, and intended plans for repowering specific assets.

Gregory Dudziak, Head of Advisory Europe at Natural Power, said: “We’re delighted to have supported the successful completion of this significant transaction in France. As an industry, we’re seeing a real increase in the focus on extending the operational life of wind farms beyond the initial design life, and it's encouraging to see this long-term view gain prominence in the transaction cycle, ensuring the viability of improved technology, and robust, safe assets producing high energy yields for longer.”