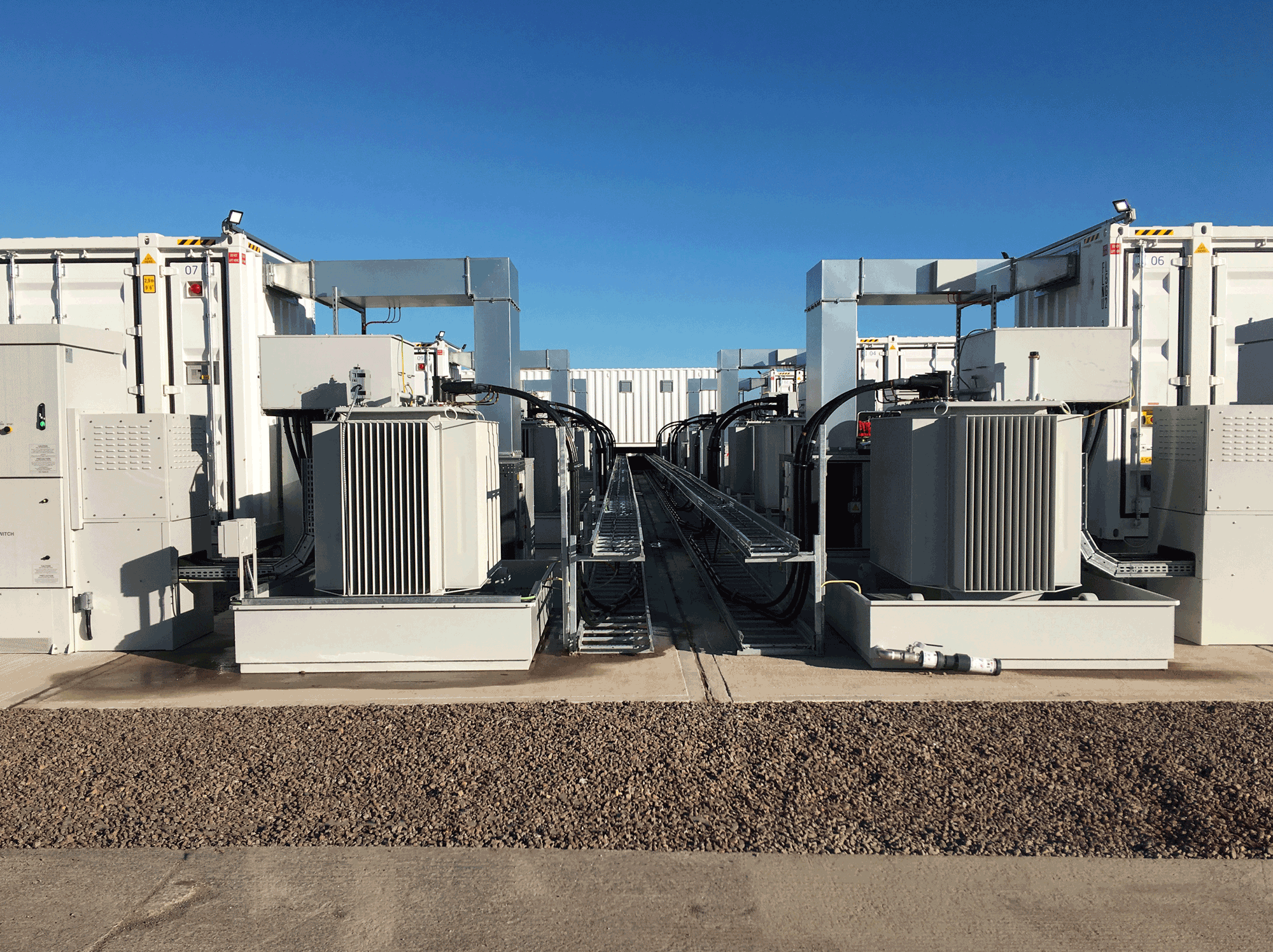

Our experience allows us to help banks, developers, independent power producers (IPPs), utilities and investment funds make good financial decisions when it comes to clean energy projects.

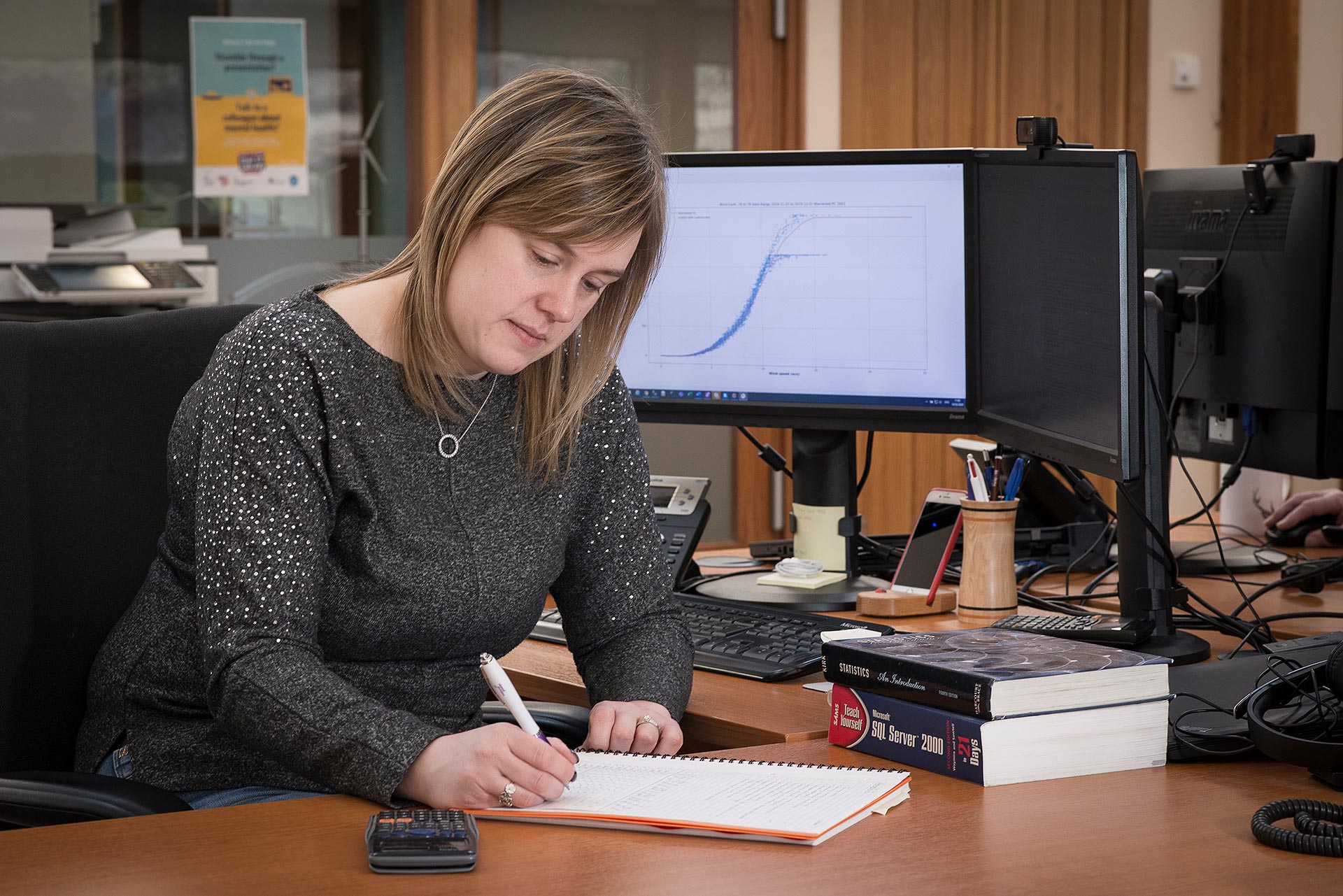

We can evaluate the potential technical risks of your project and provide you with valuable insights on how those risks might impact its continued development, construction and operation.

We offer clear and concise reporting on these risks, and we outline how to manage them effectively, so you see a good return on your investment.

We provide red flag reviews, and full scope due diligence for wind, solar, and battery storage projects, and we support buy-side and sell-side technical due diligence for mergers and acquisitions. Whether your transaction involves a single project, a portfolio, or an entire renewable energy business platform, we understand that timely, responsive analysis of the risks is key to supporting your investment decision.