What was the aim of the work?

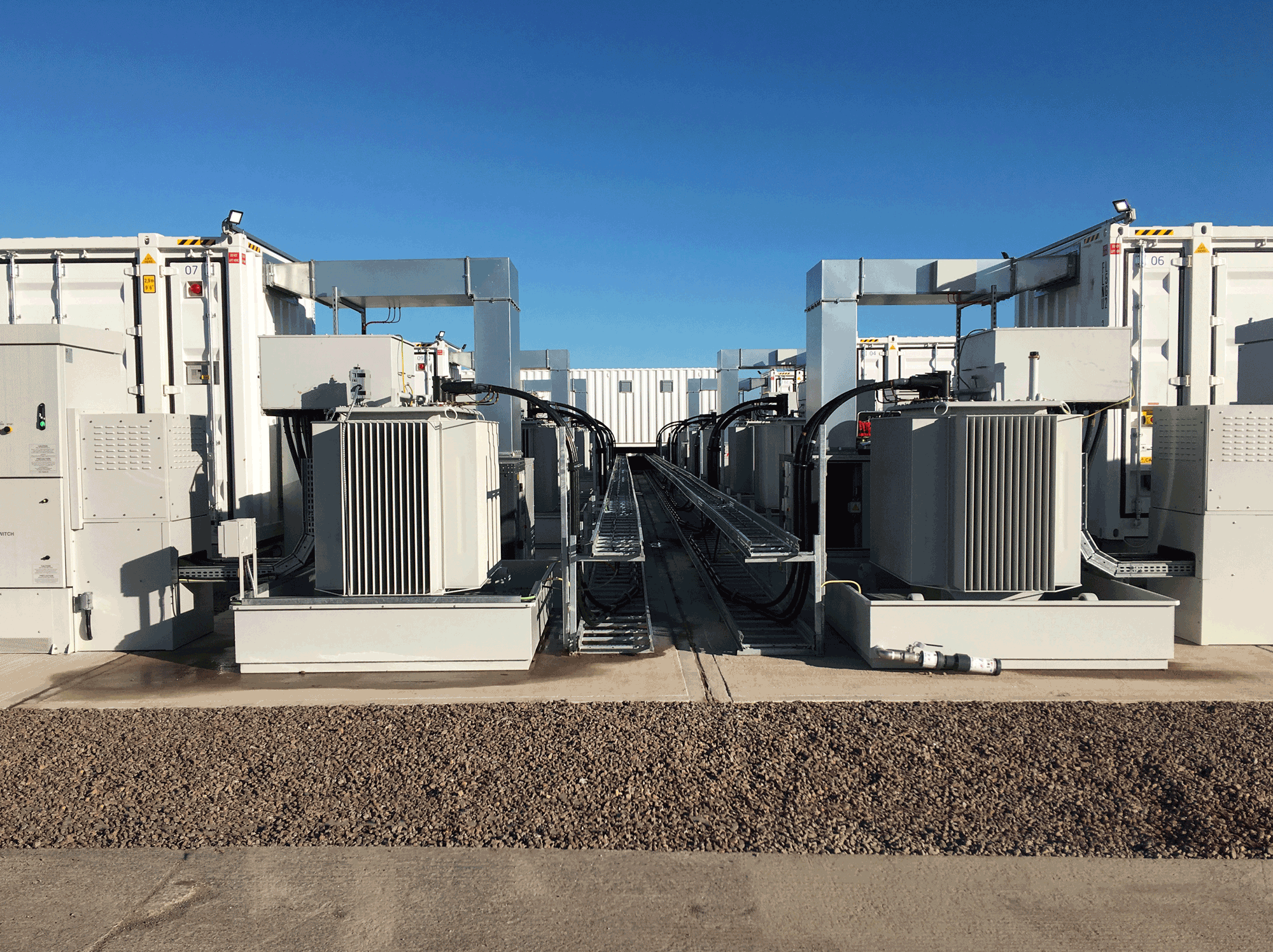

Natural Power worked with one of the market’s largest independent power producers to provide technical due diligence on the acquisition of a portfolio of grid-scale energy storage assets.

What was the outcome?

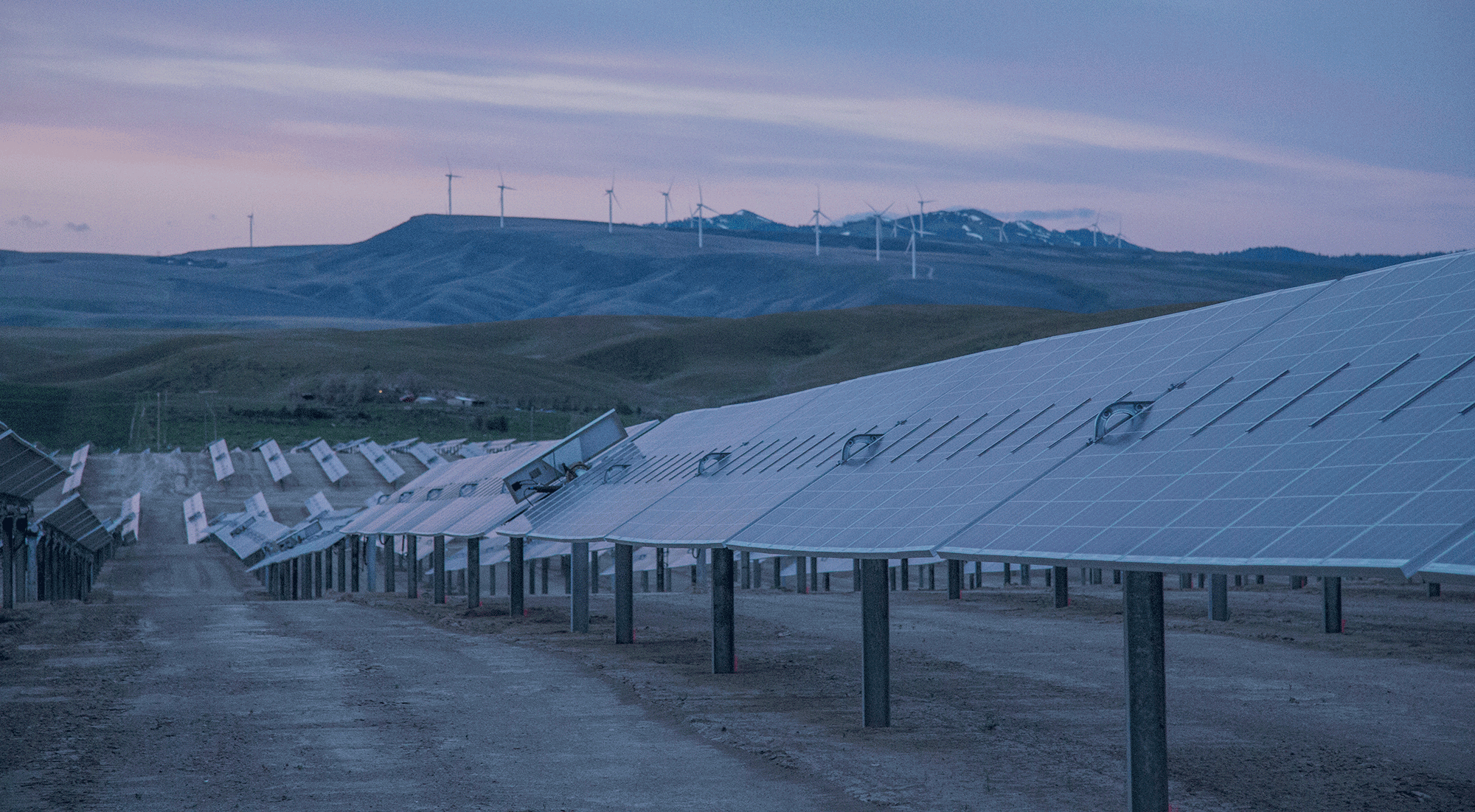

With approximately 90 MW of capacity and energy storage projects offering a range of services, such as resource adequacy, frequency response, and capacity the portfolio provided many opportunities for the client and also a complex mix of technical and financial risks to navigate. Natural Power’s technical team quickly deployed to evaluate key risks facing many of today’s energy storage projects, such as capacity degradation and suitability for participation in an optimized combination of revenue streams. The team also examined project design and technology selections in the context of rapidly evolving codes and standards.

What did Natural Power do to get this result?

Leveraging this expertise and in-depth review, Natural Power was able to help the client negotiate improved warranty coverage and a repowering program to ensure that the battery systems could meet the portfolio’s financial projections, even under the kinds of increased degradation rates that often come with maximizing disparate revenue streams.

Project stats

75 MW

The largest project in the portfolio had a capacity of 75 MW.

90 MW

The total portfolio is 90 MW.

Key revenue streams

The key revenue streams were frequency response, resource adequacy and capacity.